Content

The customer paid the full amount after 5 days to enjoy the cash discount. Please calculate the cash discount and prepare a journal entry. The size of the trade discount offered depends on the quantity of the goods purchased and the relationship between the manufacturer or wholesaler and the reseller. For example, a manufacturer may offer a higher trade discount to a reseller who purchases a large quantity of goods. According to the GST regulations, there will be no distinction between trade discounts and cash discounts.

Other businesses within the industry that make use of the manufacturer’s products rarely pay the list price for them. Instead, the manufacturer offers a discount on each purchase or a percentage of the list price to the wholesaler or retailer. Companies grant discounts for customers in order to provide incentives for them to purchase more products. This is a widely utilized sales technique in all types of organizations and, trade discount and settlement discount are two main types of discounts granted.

Benefits: Why Is Trade Discount Given?

Companies offer trade discounts to customers that they consider to be important and want to retain as clients. This can stem from things such as the amount of business that is provided by the customer or the length of the time that they have been a customer. Other reasons for offering trade discounts may include increasing sales, increasing product turnover, or offering trade discount an incentive for customers to purchase a product in larger quantities. It is essential to note that businesses do not create a new “trade discount account” to post the transaction in the books of accounts. It is neither recorded in the books of accounts of the manufacturer nor the wholesaler/retailer. Settlement Discounts are also seen in business to business markets.

To increase sales, trade discounts are allowed as a broad discount to all customers. On the list price, trade discounts are authorised, and sales are made on the basis of the net price, which is the list price minus the trade discount. As a result, no trade discount is recorded in the books of account. Cash Discount is a rate discount given to consumers in exchange for meeting particular payment conditions, primarily linked to fast cash settlement and avoiding credit risk. Cash discount, as the name implies, is linked to cash flow, i.e. cash receipt or cash payment. It encourages the buyer of the goods to pay as soon as possible in order to receive a cash discount, allowing him to pay a lower amount than what is owed to him.

Trade Discount Journal Entry

Deducted from the invoice value or catalogue price of the goods. As an incentive or motivation, for payment within a specified time. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from large corporates and banks, as well as fast-growing start-ups. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups. When Z makes payment on the 10th day, he will have to pay only 980,000 (1,000,000 – 2% of 1,000,000). About the Author – Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya.

The trade discount customarily increases in size if the reseller purchases in larger quantities (such as a 20% discount if an order is 100 units or less, and a 30% discount for larger quantities). Another difference between the two lies in how they are recorded in the financial statements. Discounts allowed represent a debit or expense, while discount received are registered as a credit or income. Both discounts allowed and discounts received can be further divided into trade and cash discounts.

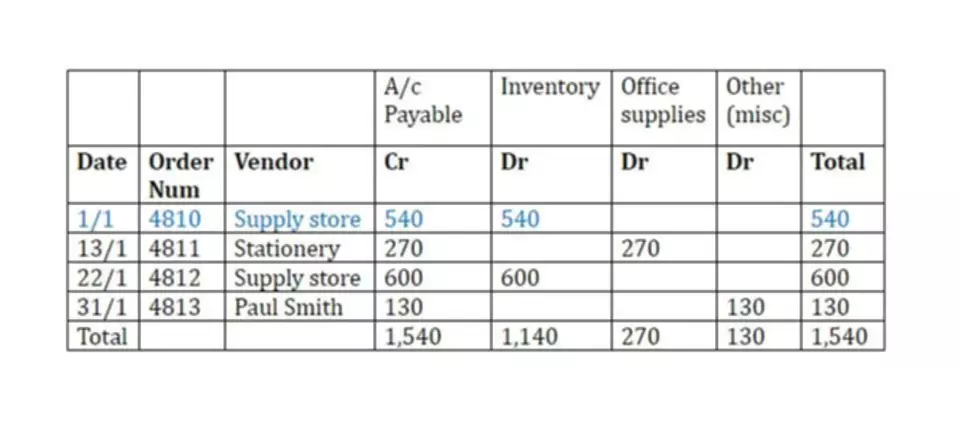

Recording Sales Having a Trade Discount

It is generally recorded in the purchases or sales book, but it is not entered into ledger accounts and there is no separate journal entry. However, here is an example demonstrating how a purchase is accounted in case of trade discount. For example, let’s say that Manufacturer M sells 1,000 units of product on credit to a Wholesaler W at a list price of $10 per unit, with a 5% trade discount granted by the seller to the buyer.

They can also give cash discounts to final customers, which helps build client loyalty. A customer can enjoy both trade discounts and cash discounts if he/she is making cash payments for the goods purchased. A trade discount is a discount given by the seller to the buyer at the time of making a sale. This discount is a reduction in the list prices of the quantity sold. The main objective of trade discount is to encourage customers to purchase company’s products in more quantities.

How Does Trade Discount Work?

She works closely with small businesses and large organizations alike to help them grow and increase brand awareness. She holds a BA in Marketing and International Business and a BA in Psychology. Over the past decade, she has turned her passion for marketing and writing into a successful business with an international audience. Current and former clients include The HOTH, Bisnode Sverige, Nutracelle, CLICK – The Coffee Lover’s Protein Drink, InstaCuppa, Marketgoo, GoHarvey, Internet Brands, and more. In her daily life, Ms. Picincu provides digital marketing consulting and copywriting services.

If your company provides a reduction in price to either individuals or other business, it’s called a discount allowed. In both cases, discounts can help increase sales and customer loyalty. Except for trade discounts — which are not recorded in the financial statements, these discounts appear as a credit on the income statement in the Profit and Loss Account. Basically, the cash discount received journal entry is a credit entry because it represents a reduction in expenses.